Top-down investing is an investment analysis method that first looks at the macroeconomic situation and then looks at the factors in more detail later. This approach focuses most on macroeconomic, national, or market factors. This is contrary to bottom-up analysis, which focuses on the company’s fundamentals and then raises the structural hierarchy by considering macroscopic global economic factors as the latter.

Top-down investing can help investors save the time and attention they need to invest in their investments, but they can also fail for profitable individual investments.

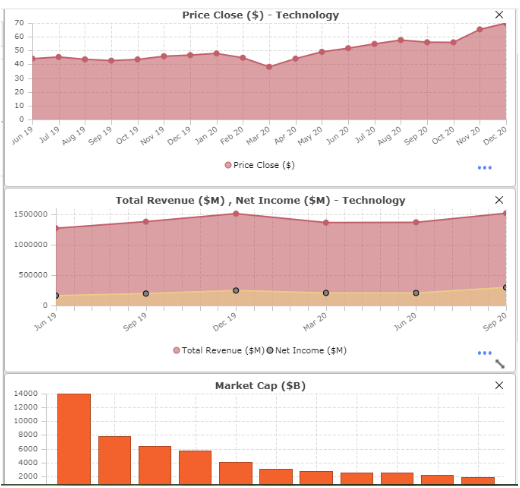

The TradingLever platform allows investors to view stock trends by Sector (or any other financial property).

For example, here are the trends of the average stock price in the Technology Sector for the last 1.5 years:

Top-down stock market analysis: the technology sector

We can certainly see growth in the Technology Sector.

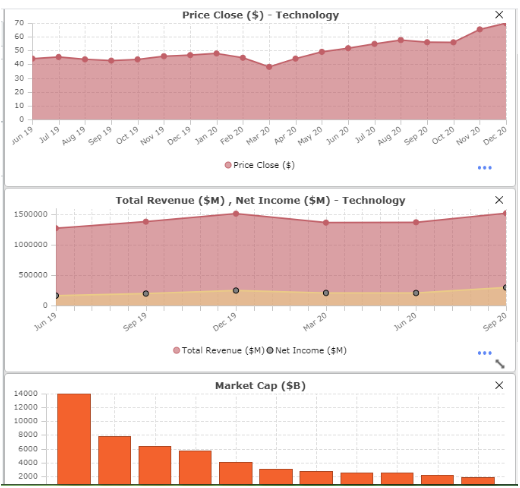

Also, here’s the same for the Consumer Durables Sector – where we also see growth, although more limited.

Top-down stock market analysis: consumer durables sector

What is top-down analysis?

The top-down analysis first looks at the “big picture” of an investment idea or stock selection. After confirming that a stock is ideal, it takes advantage of global trends, and analysts will make the final investment decision by examining the actual details and balances of that subset.

Understanding top-down analysis

Investors who use top-down analysis usually start by looking at the global economy. Then you evaluate the macro trends in the economy that you think have the best opportunities. After that, industries willing to capitalize on these macro trends are evaluated. Finally, individual stocks are selected from favorable sectors.

Looking at everything, investors use macroeconomic variables such as GDP, the balance of trade, currency movement, inflation, interest rates, and other economic aspects. After looking at the overall picture of the world, analysts examine general market conditions to identify sectors, industries, or regions that are doing well in the macroeconomics. The goal is to find a specific industry that is expected to outpace the market.

Based on these factors, top-down investors distribute their investments through efficient and diversified asset allocation, rather than analysis and betting on specific companies. For example, if Asia’s economic growth is better than the U.S. domestic growth, investors can move their assets offshore by purchasing an Exchange Trading Fund (ETF) that tracks specific Asian countries. At this point, they also take into account the underlying indicators of a particular company and analyze the stocks of some companies to select potentially successful investments.

There are slightly different tones for top-down analysis and technical analysis. It is used to get a more complete picture of the security price movement by moving from a wider time frame to a narrower time frame. First, weekly traders can analyze daily or weekly charts to identify long-term security trends with significant levels of support and resistance, and then move to smaller time frames to make a good starting point.

For example, if security tends to be higher on daily charts and bullish momentum on hourly charts, traders using downstream analytics can go to the 15-minute chart to find promising entry points for going long. Don’t know how this works, never mind, the TradingLever platform offers a free top-down analysis service that you can leverage to ensure your success. You can follow this link to head over to their site.

The breakdown of Top-down Analysis

Gross domestic product

The top-down approach always starts at the highest level. In other words, it identifies countries with the best investment environment. The most widely used measure at this level is the GDP formula for gross domestic product. The GDP formula includes consumption, government spending, investment, and net exports. GDP is an important factor to consider, but there are other considerations investors can analyze.

Geopolitical risk

Global investors must evaluate a country’s political mood before deciding to invest. Investors must decide if a country’s economy is under threat. This may be due to the political situation in the country or circumstances where surrounding countries may be threatening the economy.

Asset condition evaluation

Another factor to keep in mind is the valuation of assets as the country’s economy grows. A fast-growing economy can lead to fast-growing companies, but the industry may need a lot of money for securities.

Local currency climate

In addition to these concerns, the impact of local money (fiat currency) on investment projects should also be considered. Foreign security may seem to work well in the local currency, but once you start evaluating depreciation in US dollars, you can understand that the growth rate is not as fast as you might think.

Pros and Cons

Top-down investments rely heavily on economic aggregation and large-scale analysis of publicly available data, and involve a relatively small number of choices, allowing a better use of investor’s time and interest in relevant data in a larger area or sector compared to when you have to access than an entire list individual stocks.

However, by excluding the entire industry sector or country, including companies that outperform the market as a whole, you may miss many potentially profitable opportunities.

Should you consider using top-down analysis?

Using top-down analysis requires extensive research. You need to compare not only the economies of different countries, but also the selected sectors of the state. This means that you are unlikely to choose a company that is not performing well and this minimizes your investment risk.

Another reason to use top-down analysis is that you can diversify your investments across different sectors. You can also diversify your portfolio in global markets. If you discover a high-performing international market, you can invest some of your capital. Diversification helps mitigate the impact if the underlying markets you invest in decline.

All top-down analysis begins with a global view of the economy, so it is unlikely that investors will be caught unaware. Ideally, this strategy requires investors to be aware of geopolitical issues and the economy in general. Given the amount of global event information and interconnected networks held by these investors, it is easy to predict trends in various sectors.

All these advantages support the fact that top-down analysis is worth considering. However, this does not mean that you have to completely abandon your bottom-up strategy. Finally, you can use a combination of the two strategies. With the help of bottom-up technology, you can gain a solid understanding of individual companies before making an investment decision. This method allows you to access the financial reports of the company to see if your financial position is in good shape.

At the same time, the top-down analysis provides a complete picture of the global economy. By tracking the economic outcomes of different countries in a timely manner, you can predict the development of a particular industry invested in. It also gives you the opportunity to diversify your portfolio by investing in a variety of markets.

Conclusion

So, top-down analysis is when investors first get a complete picture of the economy and sector they want to invest in. This means they estimate the economic growth rates of many countries around the world. Once you’ve identified a potential country, you choose a specific sector that appears to thrive in that country. The final step is to choose a company that does well in the specific industries they invest in.

As the name suggests, top-down analysis is a funnel way to select investment opportunities. We have provided quite a few sample chart top-down free analysis service provided by us. We hope this explanation was helpful for you and you will use it to your benefit.