How to Analyze Stocks Using the Price-to-Earnings Ratio

The world of finance is vast and dynamic, with several components and various factors working together to create a harmonious environment. Being a financial market participant, the main objective of any investor is to select good stocks that will offer high returns and benefits in the long run. There are several ways for one to select and analyze stocks, ranging from various techniques like technical analysis and fundamental analysis. While selecting stocks for investments is a process that takes into consideration various factors, there are some crucial elements that we can focus on and get good results. One such way to analyze stocks is the price to earnings ratio or as you might have heard; the P/E ratio.

In the realm of finance and investments, an organization’s price to earnings ratio, or P/E ratio, is a proportion of its stock value comparative with its earnings. Whenever investors try and analyze whether the stock is a good choice for an investment, the P/E ratio can help measure the future bearing of the stock and whether the cost is, moderately, high, or low contrasted with the past or different organizations in similar sectors.

The price to earnings ratio was made popular by the legendary investor Benjamin Graham. He was also the mentor of one of the most successful investors in the world – Warren Buffet. Benjamin Graham believed that the easiest and quickest way to analyze a stock and determine if it would be a worthy investment was to see the financial ratios. And one of the most important ratios that an investor can use is the P/E ratio.

So let’s understand this concept in detail and see how you can use this ratio and analyze stocks, which will help you improve your investments and generate rewarding returns.

What is a P/E Ratio?

Basically, the price-to-earnings (P/E) ratio is the ratio that is used to value a company that measures its current share price relative to its per-share earnings. The P/E ratios are also known as the price multiple or earnings multiple. This ratio has been used by investors for years, and with its help analysts and investors determine the relative value of a company’s share. It can also be used to compare a share with its past record and how it has performed in the history and also compare aggregate markets against one another.

The P/E ratio assists financial market participants with deciding the market estimation of a stock when contrasted with the organization’s profit. So, the P/E ratio shows what the market participants are happy to pay currently for a stock dependent on its past or future income. A high P/E could imply that a stock’s cost is high compared with its income and is potentially overvalued. Then again, a low P/E may show that the current stock cost is low compared to its earnings.

Financial analysts and investors not only utilize the P/E ratio to decide a securities exchange’s worth but additionally also use it in deciding future income development. For instance, if the earnings are expected to rise, speculators may anticipate that the organization should increase its dividends accordingly. Higher earnings and rising dividends normally lead to a higher stock cost.

In short –

- The Price to Earning P/E ratio shows and demonstrates the relation a company’s share has to its earnings per share.

- A P/E ratio that is high could mean that the company’s stock is over valued, or that the market and analysts are expecting steady and high growth in the coming future.

- To have a P/E ratio, a company must have earnings and growth. Companies that don’t have any earnings or are in losses often do not have a P/E ratio as it is not possible to calculate it.

- The two most common kinds of P/E are the forward and trailing P/E ratio.

How to calculate or find the P/E ratio?

While the standard way to calculate the P/E ratio of any company is to divide the market value per share by the earning per share. This will give the price to earnings ratio. So while this may seem like an easy task, creating and finding the P/E ratios for hundreds of companies when an investor or analyst is looking for investment opportunities can become challenging and difficult. So that is why we will use a fantastic website to help us with our analysis, and the website is “TradingLever.com”. This is a dynamic platform to do vast and extensive stock research and analysis. So here we can easily find the P/E ratio for any company that we desire in any market sector without the tedious calculations and number analysis.

We will soon show you an example of how you can easily find the P/E ratio for any company on Trading Lever.

Price-to-earnings ratio (P/E) = Market Value Per Share

Earnings Per Share

How to Analyze stocks using the P/E ratio?

The P/E ratio can reveal incredible information about investors’ opinions for a given stock. But still, to accurately assess whether a stock is exaggerated or underestimated, it is important to look at the current P/E to past P/E proportions and also to the as P/E proportions of different organizations in a similar industry.

Moreover, while outstandingly low or high P/E ratios can give you the potential for a great opportunity or great danger, there is a chance or possible risk. Stocks can now and then keep on moving to progressively underestimated or exaggerated levels for a long timeframe before things correct.

An Example

So let’s take an example. Considering the current scenario of Covid and the pandemic, people are in quarantine. And with this in mind, you expect people to consume more technological services like the internet, online services, and similar content. Because being indoors, people need a way to entertain themselves and connect with the world. So these telecommunications services are likely to see more demand and their share prices are expected to rise. And any investor would like to grab such an opportunity by investing in companies based in the telecommunications sector. So to find stocks in the telecommunications sector and their P/E ratio, we will head over to the TradingLever platform. There we can see and analyze all the stocks with their P/E ratio.

So, let’s begin. First, we head on over to TradingLever.

Website link – ask us for a link.

IMAGE 1.0

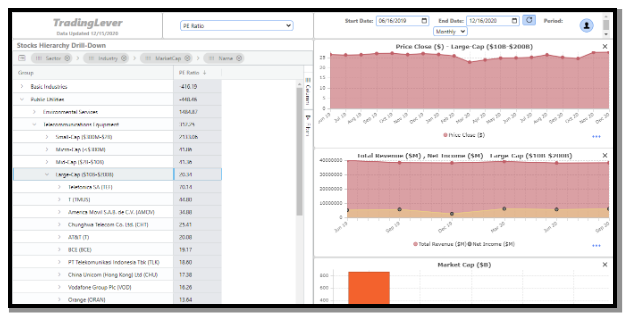

Now here you can see in image 1.0, the webpage is displaying various information and data. Now what we need is the P/E ratio for the telecommunication sector. And in that, we shall be focusing on the large-cap companies. So let’s go forward.

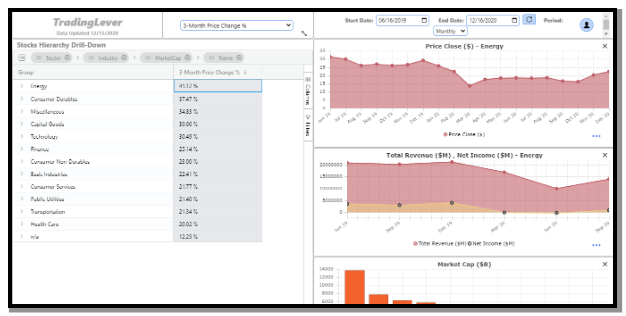

IMAGE 2.0

Now, as you can see in the above image number 2.0, we head on over to the tab where we can select the criteria we want to analyze our stocks with. We select the PE ratio as that is what we are looking for.

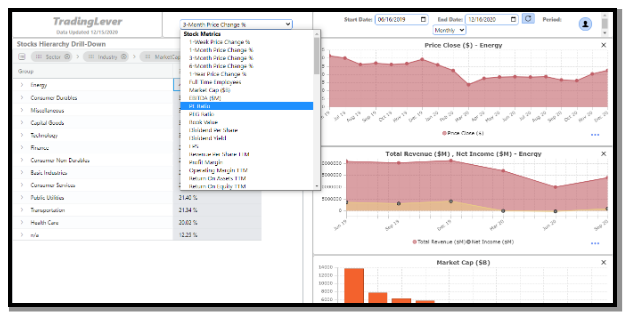

IMAGE 3.0

Now in image 3.0, we can see that the PE ratio information has been opened. So to find the telecommunication sector, we will head on over to the “Public Utilities” tab. And in that, we can clearly see the “Telecommunication Equipment” tab. This will give us the P/E ratios for all the companies in the telecommunications sector.

IMAGE 4.0

Now, as you can see in image 4.0, we are finally at the telecommunications sector tab. And here, we can clearly see that there are four tabs that we can select from. There is the – Large-cap, Small-cap, Mid-cap, and Micro-cap section. We have to focus on the large-cap companies as they hold the greatest potential and can prove to be great investments in the coming time.

So finally, here we can see the various telecommunication companies like AT&T, Telefonica SA, America Movil S.A.B, and many more. Here we can see and compare the P/E ratios and choose the company that suits our requirements the most and has a balanced yet attractive P/E ratio. This will result in a good and researched investment decision and will deliver great returns.

Conclusion

So, now with the above information, you can go ahead and analyze and select stocks using the price-to-earnings ratio and find investment opportunities in various stocks. However, we would suggest that you do proper due-diligence about any company before you make investments, as the stock markets are a risky place and capital security should be your number one priority.